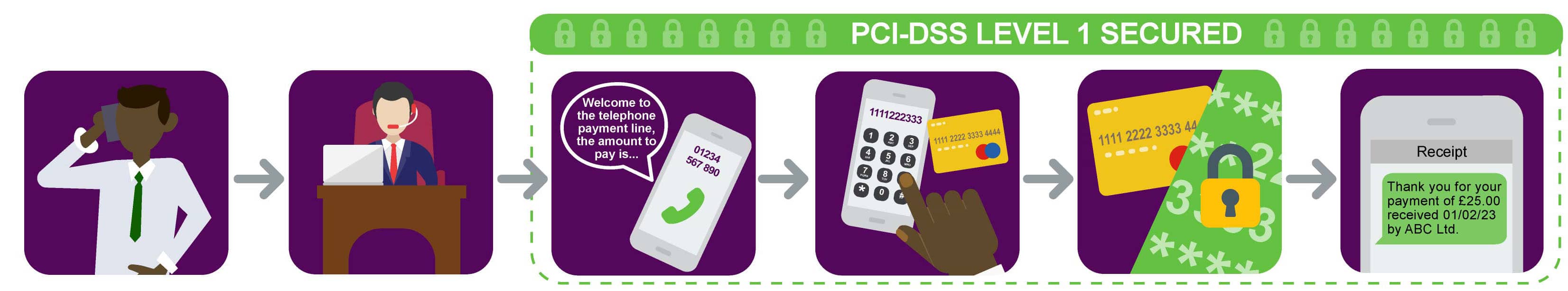

We’ve been delivering secure Payment IVR solutions since 2003, helping organisations cut down on inefficiency and outdated ways of collecting payments. We help realise your goals of reducing the time and money spent on taking and processing payments, through offering a fully-automated payment collection and processing system.

Our IVR designs are rigorously tested and aligned with your existing business systems to offer your customers a painless transaction process.

Your solution will be fully branded and bespoke to you, with professional voice artist recorded messages included. Multi-lingual and multi-currency support is also available.

Our PCI-DSS Level 1 compliant platform can process payments for a variety of sectors and services across the world – ranging from utilities, insurance, parking, through to financial services and local authorities.