How Secure Over-the-Phone Payments Work

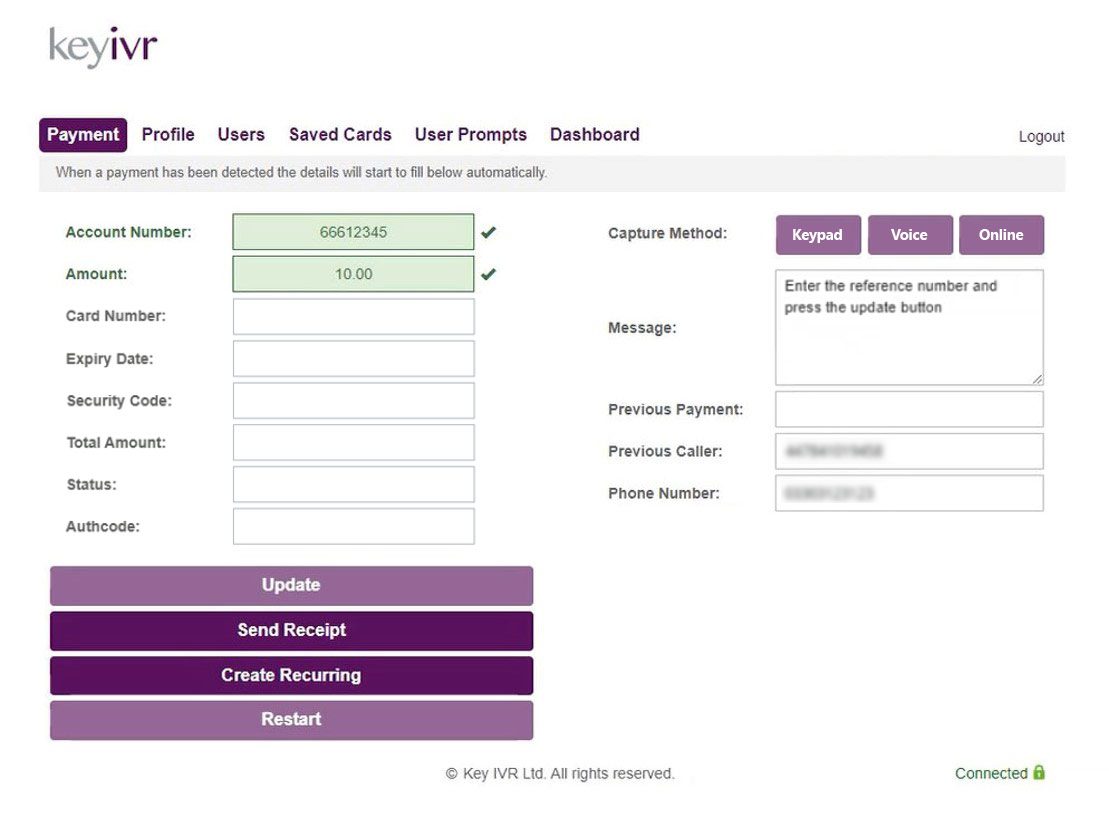

Key IVR’s Agent Assisted payment solution is a PCI-DSS compliant service. It helps remove sensitive data from your business or contact centers when customers are paying over the phone with an agent. When the customer is ready to make a payment, there are three ways that sensitive cardholder data can be given to the agent:

They can read out their card details and the information is captured by secure voice recognition, they can enter it on their phone screen, using a link sent by text message or email, or they can enter the card details using their telephone keypad, with DMTF tones suppressed. For voice recognition or keypad entry, the agent needs to secure the call first – but this is done all within a few seconds.

All sensitive cardholder details are removed, preventing them from ever reaching the agent or your call recording system. The payment is then processed, and the details are checked with the payment gateway provider. Ensuring all the information is correct, the payment is successful. If the payment fails, the agent will be advised on screen, and ask the customer for an alternative payment method.

There are also options to save card details securely for a customer to use on future payments and set up payment installment plans.

The Key IVR Agent Assisted payment service effectively descopes your agents and over-the-phone payments from PCI-DSS compliance. It connects to virtually any telephony setup, works with all major payment providers, and has very flexible integration options. This helps you achieve compliance for your office environment, contact centre, network, back-office systems and call recording software. It also protects agents, wherever they are in the world, even if they are working from home.

Find out More

Our Agent Assisted service is very flexible to suit your business requirements, but no matter what, payments are taken safely and securely. Contact Key IVR today and we can discuss how this service can benefit your organisation, call us on +44 (0) 1302 513 000 or email sales@keyivr.com

Agent Assisted Payments Demo

We'd be happy to show you our over the phone payments solution in action with a one-to-one demonstration from a Payment Specialist.

Submit your details and we'll be in contact to arrange a demo.