If someone asked how long you spend managing your Direct Debits, could you answer honestly? Most businesses wouldn’t be able to say, or will probably underestimate the overall time and effort spent nurturing this crucial revenue channel.

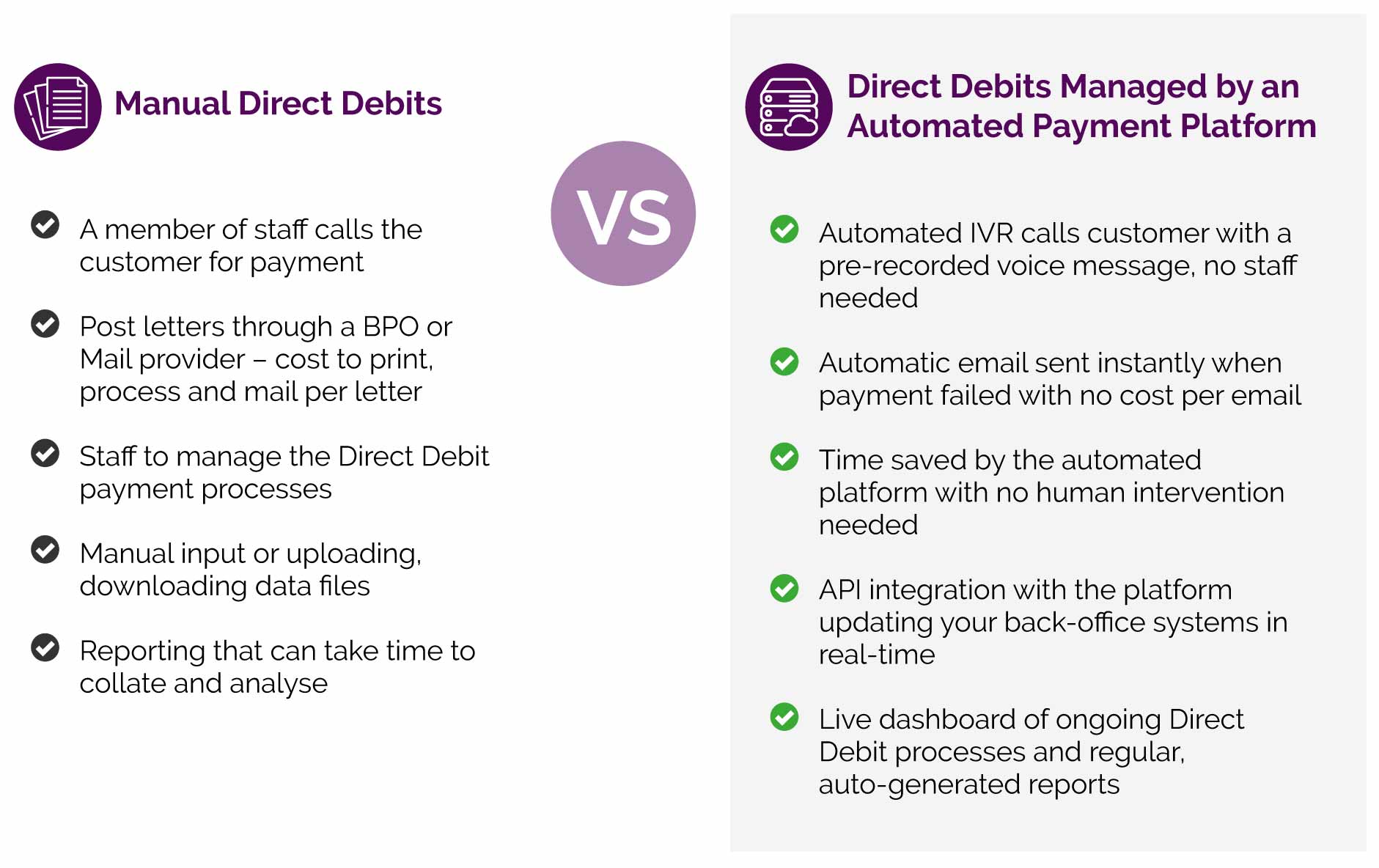

Managing the sheer volume of Direct Debits within your organisation can take up more time and money than you may realise. For every customer, you have to set up the Direct Debit, chase for any failed payments and consolidate their accounts on a monthly basis. Amplify that process across your entire customer base, and it becomes a mammoth task, requiring the time and cost of a full time member of staff (or even a dedicated billing team) to maintain it.