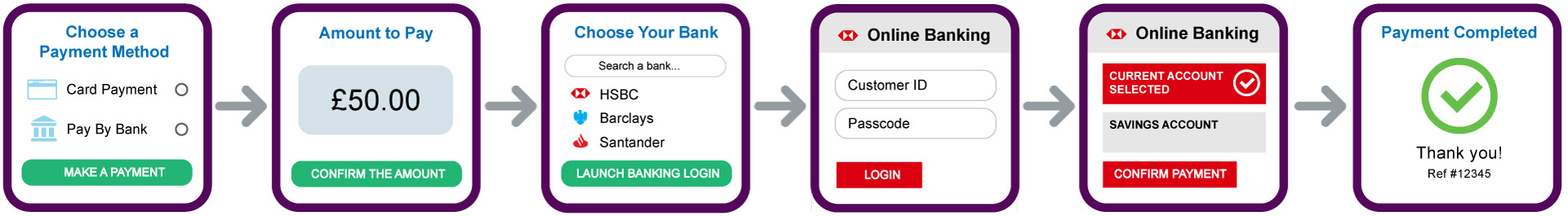

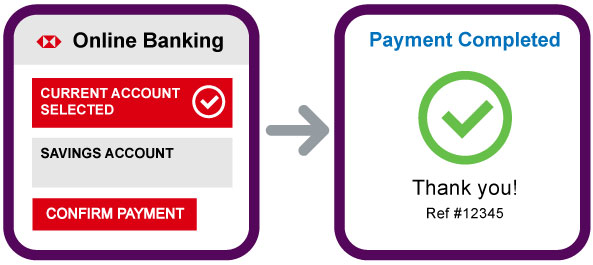

Add bank-to-bank transfer options to your online payment journey, and receive funds straight away, free from any risk of chargebacks and card-not-present (CNP) fraud.

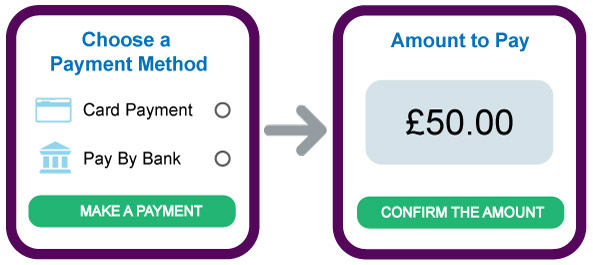

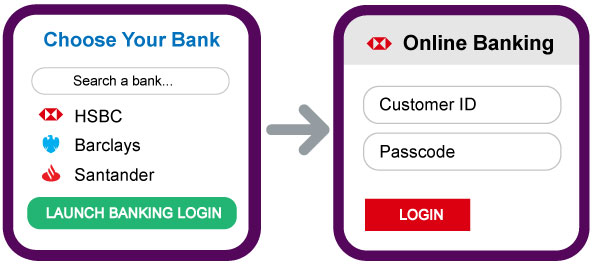

Customers can pay directly on desktop, mobile, or using their banking app, without the need to remember sort codes or account numbers.

All powered by the open banking initiative, growing 500% since 2020.