Payment processing has great significance for Building Societies as reliable and secure services are expected from a trusted financial institution.

To focus on the needs of its members, Building Societies can implement self-service payment options that drastically increase the ease of taking payments and make the whole process smoother. Automated channel will free up the agents’ time and let them concentrate on customer support. Payments can be made anytime 24/7/365.

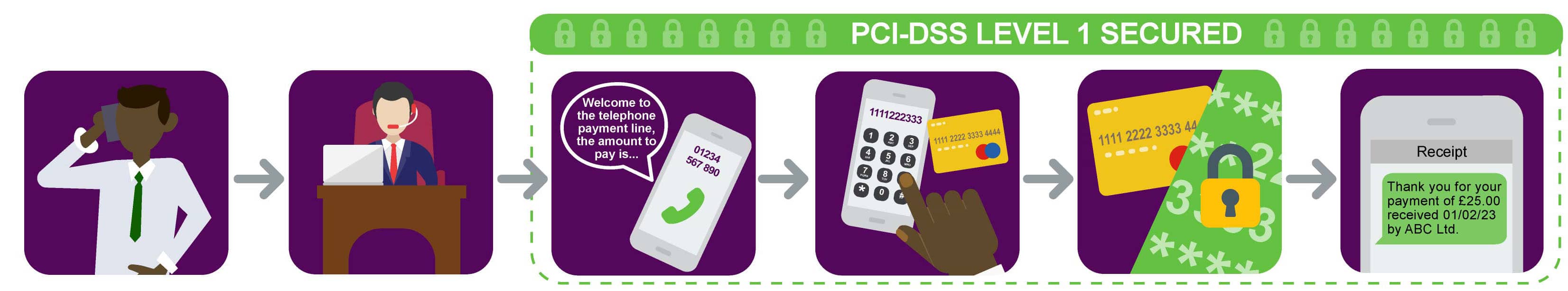

Our Payment IVR Solution is PCI-DSS Compliant, which means it reduces any risk of malicious attacks and data breaches that can lead to irreversible consequences.

Key IVR will help you create and implement the solution that fits your organisation perfectly and meets all your business requirements, saving valuable time and money without comprising customer experience.